Top complaints of financial advisors:

Backed by On-Demand Expert Services:

Dan Calandro is a financial scientist and creator of an award-winning method that features his patent-pending 15-51™ allocation system that defies conventional “wisdom” and reliably produces more reward with less risk – not exactly cliche. But then again neither is Dan.

The book is a great example of Dan’s strategic process, which delivers a winning strategy to build and manage portfolios that consistently achieve objectives. The book demonstrates how Dan created his portfolio.

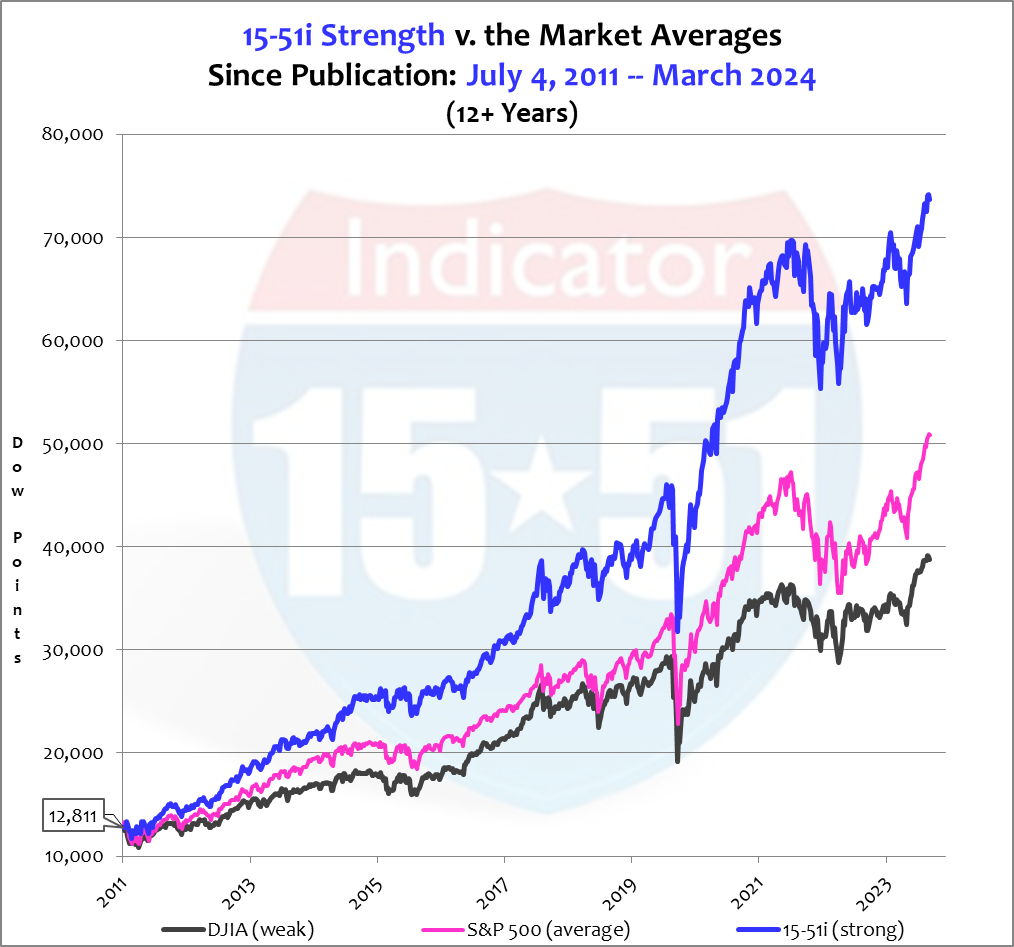

Called the 15-51 Strength Indicator™, the purpose of Dan’s portfolio is to indicate how stock market strength is performing. To do so successfully it must produce above-average gains with less risk while moving in a “market-like” manner. It does so reliably.

15-51™ = Strength

Connect now to discuss how Dan’s innovative approach can strengthen your portfolio and increase performance — with less risk.

Service Point of Difference: Dan is not a registered financial advisor or third-party money manager so he has nothing to sell but time, expertise, and candid support derived from unregulated free speech and analysis. So if you’re looking for a second opinion or alternative method that actually delivers on the promise of investment, book a free exploratory discussion now. There’s nothing to lose.

Headquartered in Sandy Hook, CT

Dedicated to the United States of America

Website Copyright © Cal Management Group

Website Design By DS